The Transaction Advisory Services PDFs

Table of ContentsTransaction Advisory Services Can Be Fun For EveryoneSee This Report on Transaction Advisory ServicesFacts About Transaction Advisory Services RevealedHow Transaction Advisory Services can Save You Time, Stress, and Money.Some Known Questions About Transaction Advisory Services.5 Easy Facts About Transaction Advisory Services DescribedHow Transaction Advisory Services can Save You Time, Stress, and Money.

In our career, the term "consultatory solutions" is made use of regularly, but there is little agreement regarding what it really indicates. When we ask multi-service firms which advisory services they offer, the range of responses is exceptionally broad and frequently overlaps with standard conformity services. Discover a lot more Conformity solutions are needed, and there is very little differentiation in the deliverable between specialists.The fact that a lot of companies include the exact same conformity summary on customer billings strengthens that there is nothing special about the conformity report. Alternatively, the advice, expertise, preparation and strategy that went right into the process prior to the report was developed are really distinguished.

Compliance reports are the main worth communicated, delivered and invoiced to the client. Workable insights and methods are the key worth connected, provided and invoiced to the client. Compliance reporting is a by-product of distinct advising services. Deadline driven Historic client documents Information entry and format Confirmed computations Done by the expert Uniform records Year-round task Live data Prepared for review Automated reporting Collaborative approaches Customized understandings Conformity solutions in accountancy simply means ensuring the firm's monetary records, reports, and filings abide by the suitable guidelines and standards for the kind of business.

Transaction Advisory Services for Dummies

It could be broadening your customer base, new product, or increased sales volumes, each with complicated functional and economic needs. On one side, development is a great signal, and on the other, it requires intending if it needs to be sustained. This can be an arrangement to framework and have systems in location to make sure that more activities can be permitted without stressing sources.

Practices introduced during the duration are at top performance, stopping typical problems such as cash money lacks or over-extended sources from stopping expansion. A secure money circulation lies at the heart of health for any kind of firm, but it can obtain very complicated to take care of when the marketplaces obtain stormy. Generally, the symptoms of a cash-flow trouble show much deeper concerns in financial administration, pricing approach, or expenditure control.

Company advisors may additionally supply turnaround methods that will certainly examine existing financial practices and determine locations of enhancement when there is installing debt or decreasing profitability. They may aid to restructure financial obligation, renegotiate contracts, or simplify procedures so regarding minimize prices and ultimately have much better economic health.

With its home advisors, the companies can minimize economic threats and begin working towards constructing healthy and balanced cash money circulation to support lasting development. Strategic preparation is a has to for any type of company that intends to be successful over the long term.

7 Simple Techniques For Transaction Advisory Services

Governing conformity is essential to maintain lawful standing and protect the online reputation of a business. However, regulative needs in very controlled or dynamic markets can be really expensive and time-consuming if not correctly managed. Whether it be in health care, try this site financial resources, or any type of production company, it becomes really crucial to keep updated with all the regulative requirements.

They therefore aid facilities establish their very own conformity programs and develop reliable record-keeping methods to keep them updated with altering legislation that may affect their operation. Prevention of click to find out more disturbances in procedure and protection of track record is consequently feasible through proactive conformity. Organisations must prepare for risks that can influence their day-to-day operations and the lasting success of business in unsure company settings.

Experienced financial leadership is needed to assist long-lasting technique and operational efficiency. Supplies comprehensive financial monitoring, from calculated planning to run the risk of analysis.

How Transaction Advisory Services can Save You Time, Stress, and Money.

Our years of experience managing purchases of all kinds suggest that we recognize the financial and emotional sides of the procedure and can be one action ahead of you, preparing you wherefore to anticipate following and keeping an eye out for difficulties in the process. Our company prides itself on fostering long-term connections with our clients.

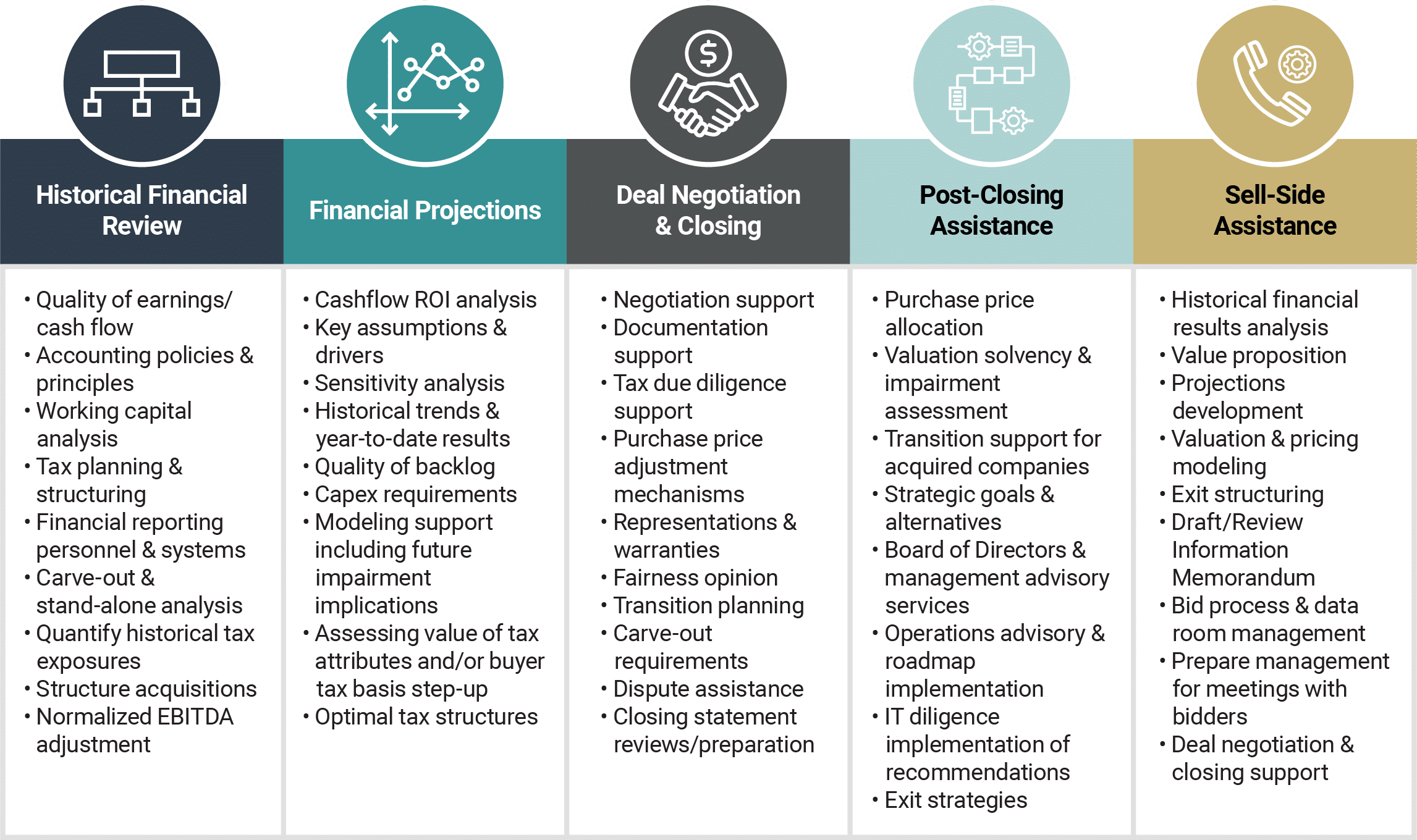

Establish innovative financial frameworks that assist in figuring out the real market worth of a firm. Provide advising job in relation to organization evaluation to assist in negotiating and rates frameworks. Describe the most suitable type of the offer and the sort of factor to consider to utilize (money, stock, make out, and others).

Establish action prepare for threat and exposure that have actually been recognized. Transaction Advisory Services. Carry out assimilation planning to identify the process, system, and organizational adjustments that may be needed after the bargain. Make mathematical estimates of integration expenses and advantages to examine the financial rationale of integration. Set guidelines for integrating departments, innovations, and service processes.

Our Transaction Advisory Services Ideas

Finding the out-of-pattern transactions that are not associated to normal operations of the organization. By assessing these facets, experts can approximate maintainable incomes capacity of the business as compared to reported earnings declaration.

Certain activities, timeframes for product or services assimilation, selling techniques. Define targets for cross-selling activities, brand adjustment. Scout a plan for integrating finance, HR, IT, and various other departments. Address consolidation of address systems, location strategy, job effects. Determine opportunities for minimizing head count, purchase expenses. Estimate possible expense decrease with the moment frame for each and every activity.

Our years of experience managing transactions of all kinds mean view publisher site that we recognize the monetary and emotional sides of the process and can be one action ahead of you, preparing you of what to expect following and watching out for difficulties along the way. Our firm prides itself on cultivating long-term partnerships with our clients.

10 Simple Techniques For Transaction Advisory Services

Develop innovative monetary frameworks that help in figuring out the actual market worth of a firm. Provide advisory operate in relation to service appraisal to assist in negotiating and pricing structures. Describe the most ideal type of the bargain and the sort of factor to consider to employ (cash, supply, make out, and others).

Carry out combination preparation to establish the procedure, system, and organizational adjustments that may be called for after the deal. Set standards for integrating divisions, technologies, and company processes.

Identifying the out-of-pattern transactions that are not connected to normal procedures of the company. By assessing these facets, experts can approximate maintainable profits capacity of the service as contrasted to reported income declaration.

10 Easy Facts About Transaction Advisory Services Explained

Determine prospective decreases by lowering DPO, DIO, and DSO. Examine the prospective customer base, sector verticals, and sales cycle. Consider the opportunities for both cross-selling and up-selling. The functional due diligence supplies important insights right into the functioning of the company to be obtained concerning risk evaluation and worth development. Recognize short-term adjustments to finances, financial institutions, and systems.

Details activities, durations for item and solution integration, marketing techniques. Address consolidation of address systems, place approach, task results. Price quote possible cost reduction with the time framework for each activity.